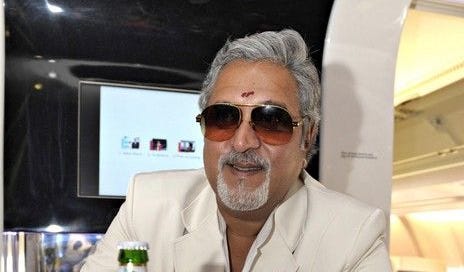

The King of Good Times: Vijay Mallya's Rise, Fall, and the Surprising Survival of Kingfisher and RCB!

The Bitter Brew of Greed: How Vijay Mallya's Quest for More Ended in a Scandalous Scam with Kingfisher Airlines!

Born with a silver spoon in his mouth, Vijay Mallya inherited his father's position as the chairman of United Breweries (Holdings) Limited at the tender age of 28. He wasted no time in launching India's most premium beer brand, Kingfisher, in 1978. Under Mallya's leadership, the UB group grew into a multinational conglomerate with over 60 companies. But Mallya's ambitions were not limited to just brewing beer; he wanted to take his brand to new heights.

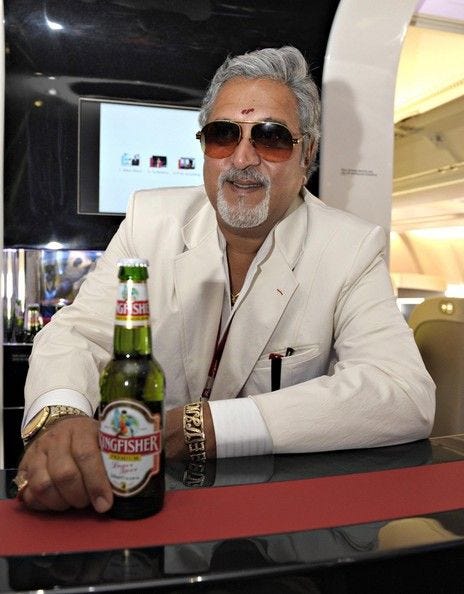

In 2003, Mallya decided to spread his wings and established Kingfisher Airlines under the UB umbrella. The airline quickly gained popularity and even earned the coveted "5-Star Airline Status" on paper. However, despite all the right moves on paper, the airline failed to turn profitable, and Mallya's grand plans started to unravel.

Bending the Rules and Breaking the Bank: How Vijay Mallya's Acquisition of Air Deccan Led to Turbulence for Kingfisher Airlines

Mallya's first misstep was the acquisition of Air Deccan in 2007. In order to obtain an international license, an airline must have at least 5 years of experience in the domestic market. Mallya circumvented this rule by merging with the low-cost carrier Air Deccan, gaining access to international routes but also inheriting its losses in the process.

Sky High Dreams, Crash Landing Reality: How Vijay Mallya's Ambitions in Foreign Airways Left Kingfisher Airlines Grounded

Furthermore, Kingfisher Airlines ventured into the international market with minimal experience, only to be crushed by competitors like Etihad and Emirates. In an attempt to reverse the situation, Kingfisher Airlines even entered the low-budget segment, but this move tarnished its premium image.

Fueling the Flames of Failure: How Rising Fuel Prices Burned Kingfisher Airlines' Profitability

To make matters worse, the rising fuel prices in the aftermath of the 2008 recession dealt a severe blow to Kingfisher Airlines. The airline struggled to cover its fuel costs, and lawsuits piled up due to unpaid fuel bills. Mallya's attempts to secure loans from Indian banks to save the airline only resulted in more losses.

In 2012, Kingfisher Airlines finally came crashing down, and Mallya fled to the UK in 2016 following charges of bank loan defaults. However, despite the airline's failure, Kingfisher beer and the IPL team Royal Challengers Bangalore (RCB) survived.

A Tale of Two Brands: How Kingfisher Beer and RCB Survived after Kingfisher Airlines Failure!

Mallya had significant stakes in two companies, United Breweries and United Spirits. Heineken bought out Mallya's 15% stake in United Breweries for ₹5,825 crores in June 2021, increasing their ownership to 61.5%. Mallya also sold his controlling stake in United Spirits to Diageo, a global leader in beverage alcohol, who now owns 55.94% of the company. United Spirits has a portfolio of 80 brands, including Royal Challenge, which RCB was named after, and Diageo-USL is now the owner of RCB.

Vijay Mallya's vision for Kingfisher Airlines was to sell not just a bottle, but a lifestyle. The airline represented aspirational living, and having a brand's name on an airplane added to its allure. Mallya was a genius at building aspirational brands by tapping into the human psyche, but unfortunately, an airline as a branding exercise proved to be financially unsustainable.

Selling a Lifestyle, Not Just a Bottle: Vijay Mallya's Genius Branding Strategies Didn't Fly with Kingfisher Airlines!

In the end, the "liquor baron" ended up digging his own grave with his ambitious but ill-fated venture into the airline industry. It's a cautionary tale of how greed and overambition can lead to downfall, even for someone with Mallya's business acumen.

Hey,

Each week, I write and send you a newsletter to bring you up to speed with the information I think you might find interesting.

Do you want me to write about you or an interesting story of yours? Or are there any particular stories you want me to cover?

Not only will your response give me great ideas, but it will also enable me to understand how we can improve the newsletter reading experience.

Just respond to this mail, and let me know :)- If you enjoyed reading this, please share it with your friends.

I want to grow this community as much as I can. (Psst, if you share it on LinkedIn or Twitter, do tag me so I can engage with you)- If this e-mail was forwarded to you and you liked what you read, you can subscribe to Weekly Writamins by AK by clicking here.

It’s free, and I send only one mail per week.- Most importantly, if WWAK didn’t land in your primary inbox, please move it from your social/promotions tab to your primary inbox so you never miss any of my emails.

See you next week,